Should Subway be installing charging stations?

My thought exercise on the future key players and locations of EV charging stations

The last few months have brought a number of announcements related to EV charging installations, and they have come from a surprisingly wide range of companies. Here are a few that caught my eye and represent the diversity of players becoming involved:

Subway building “Charging Oasis”

Hertz and BP partner to build charging stations at Hertz locations

GM installing chargers at its dealerships

Electrify America also building charging “Oases”

Mercedes plans a charging network

These got me thinking - who will end up being key players in EV charging, and will it include some unexpected companies? This post is essentially my thought process of how the future of charging can shape up.

Landscape

Before answering these I had to wrap my head around the different models and players out there today. Here’s my simple take

Existing models

Networks from vehicle manufacturers (Tesla, Mercedes) - these can be open or closed. Tesla has been traditionally closed but may be opening up. Mercedes says theirs will be open, but with preference to Mercedes drivers.

Charging hubs from charging companies - like the Electrify America stations

Distributed charging locations as a partnership with property managers - restaurants, grocery stores, malls, apartments, etc.

At-home charging products - like this

So the interested players and their incentives look something like:

Vehicle manufacturers - support sales of their vehicles by reducing the fear/stress of lacking charging infrastructure.

Charging companies - sell hardware, installation, and services to property managers, or potentially sell the electricity themselves.

Property managers - support their primary business (for example residences attracting tenants, or restaurants attracting customers), or to sell electricity

The real question…

Two things are clear

There is strong incentive for car manufacturers because it supports the sales of their own vehicles, by reducing fear of EVs for its customers.

There is some value split between the property manager and equipment owner for other public charges

So my real question is - do these less obvious partnerships make sense, and can companies like Subway and Hertz add value to the charging ecosystem?

What this really comes down to is where people actually want to charge their vehicles. In order to answer this question, we have to look at different customer segments that have different charging needs.

Use Case by Customer Segments

Individual drivers

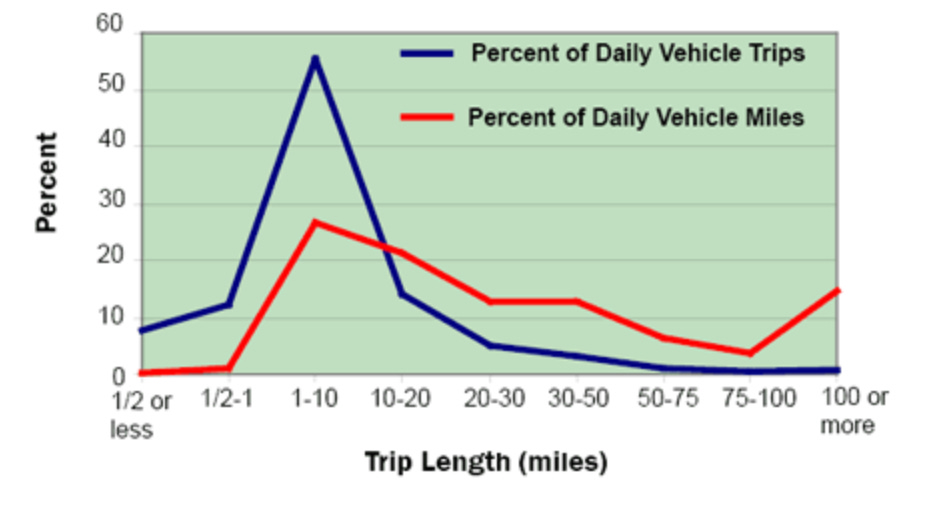

Almost all charging will occur in homes. According to the DOT, less than 1% of trips are more than 100 miles, while almost all EVs sold in the US will have a range of more than 200 miles. With a typical 120v connection you’ll be able to charge at least ⅓ of the battery as your car sits in your garage or driveway.

⅓ may not seem great, but trips that exceed this range are not common. So if you really need a full charge, it will usually be possible to accrue over the course of a few days. Additionally, you can install a level 2 charger in your home which will deliver 10-25 miles in range per hour (per DOT and NPR). While this is an added cost, charging at home is cheaper, and is unquestionably more convenient than interrupting a trip. Therefore money spent on charging will tend toward at-home rather than on-the-road.

So - will most drivers use charging stations at fast-casual restaurants or other locations throughout a city? Not often.

Of course, there will be some trips that are (1) overnight, or (2) exceed the range or remaining battery of a vehicle. For overnight trips, it is most convenient and cheapest to charge the vehicle overnight, just like at home. This will lead to chargers at hotels and airbnbs, rather than restaurants. For (2), there will be some demand for chargers elsewhere. Restaurants would be very convenient, but the limited demand probably won’t drive a wide distribution of chargers in many restaurants. Instead, I would expect more of a charging hub model on major highways with food and other amenities. This will require a bit more planning for drivers, but google maps will have you covered.

Pulling this all together, most miles will be powered by home-charging, so investments in urban/suburban charging hubs won’t have a strong return. Announcements like the Subway seem cool, but they won’t be prevalent in the long run.

Unfortunately this creates a problem. The lack of real demand for charging stations will of course result in fewer charging stations, but this will drive a greater fear of EVs. That <1% of trips will have an outsized impact when a customer is choosing whether or not to buy an electric vehicle, and a lack of charging infrastructure will be a determining factor. Government funds are a way to combat this problem, but it will lead to low utilization in the long run, and chargers will not be maintained. This is where vehicle manufacturers come in. They have real incentive to build stations so their customers will buy their cars.

This all assumes that you are able to charge at home, and does not address apartments that lack chargers. Charging stations in apartment buildings will have to eventually become a status quo if EVs are eventually the only vehicles sold. The charging market will eventually be directed to the most convenient locations, and within apartment buildings is definitely the most convenient. There will of course be a subset that is too expensive to retrofit for the rent being paid.

Gig drivers

While the average car owner will not need charging stations, it is possible that gig drivers will. There are two distinct types of delivery when it comes to charging:

Retail and grocery - for example delivering directly from a Walmart store or Amazon Fresh warehouse. These will be longer routes that may return to the original pickup point. Drivers will never be allowed to charge while on a route, so it will make most sense for the driver to charge on-site if it is available. I expect retailers will offer charging as a way to retain drivers (or create some nearby partnership that offers the same), and possibly even sell services to them. If not, this could create some small charging demand.

Food Aggregators and rideshare (DoorDash and Uber) - This is an interesting use case because drivers could rack up >200 miles in a day, especially if they live outside of a city. This is the best use case for charging hubs, which could come from a few sources within a town or city.

QSRs, convenience stores, etc. - these would minimize the additional miles driven to recharge. A restaurant could at least give a driver time to eat, but it doesn’t take that long to eat at a fast food restaurant.

Mobility hubs - properties that leverage their real estate across different use cases. For example EV charging with amenities, cloud kitchens, micro-fulfillment, scooter/bike share charging, etc.

Charging “Oases” - purpose built charging hubs with amenities like food and wifi. These could be built by a number of companies, such as Mercedes or Electrify America

Uber / DoorDash charging hubs - These companies may build exclusive charging hubs in order to motivate drivers to stay on their platform.

While gig drivers can create some demand for charging stations or hubs, we’re still talking about a fraction of the total miles driven. Even uber drivers will charge at home, and only the most active drivers will require charging in cities. So I don’t think there will be significant demand for urban charging stations.

Delivery fleets

Another potential customer segment with a high number of miles driven will be last mile delivery fleets. These could be from logistics companies (Fedex), retailers (Amazon), or even CPG companies (Pepsico). However it makes most sense for these companies to charge vehicles at their facilities. They won’t charge on-route because they would be paying the driver for unutilized time, and the vehicles must return to the station for new pickups. We can expect charging companies to sell services to these customers, but Fedex drivers won't be charging their vehicles at a restaurant.

There are other customer segments missing from here. Telecomm, public transit, and other public fleets have high mileages as well, but I expect they will be similar to delivery fleets and charge on-site. The main use case not covered here is long-haul which would require a separate exercise.

Key Takeaways

After thinking through all of this, here are my key takeaways:

Individual drivers will usually not charge outside their homes. When they do, it will only be on very long journeys and they will charge somewhere overnight (like a hotel), or on the roadside. These make up a very small % of trips, so it is not enough demand to drive high prevalence at restaurants or other distributed merchants in a city.

The lack of charging demand creates an interesting problem. There isn’t a great business case for building charging stations, but a lack of charging stations will concern potential buyers of EVs and dampen demand.

Therefore - vehicle manufacturers have the most incentive to fund charging stations. Even if they aren’t utilized, the return comes from potential customers feeling comfortable with buying their vehicles (they could even build it into the vehicle price).

There is a small use case for gig drivers, so we will see some build of charging/mobility hubs. I don’t think these will be standalone, and must offer the builder/investor some other value. For example

Driver retention from Uber / DoorDash

Sales of some other product being offered

Increase return on an already utilized real estate investment

The key business for charging companies will be offering services. Installation, maintenance, EV fleet management software, anything associated with home charging, etc